Your personal score is a vital rating that reflects your track record when it comes to managing loans. It's essentially a snapshot of your past with borrowing, and it can significantly impact your ability to get favorable terms on loans. A high credit score shows that you're a worthy borrower, making it more likely for lenders to offer you financing at lower interest rates.

Understanding your credit score and report is the primary step in taking control of your economic future. A credit report provides a detailed analysis of your lending activity, including accounts, payment history, and any outstanding balances. It's crucial to periodically review your credit report for truthfulness.

Here are some key reasons why understanding your credit score and report is essential:

- Gain better financial products

- Reduce interest rates on borrowing

- Boost your overall financial well-being

- Avoid identity fraud

By making the time to understand your credit score and report, you can empower yourself to make smart financial choices.

Get Your Free Credit Report & Take Control of Your Finances

Are you eager to improve your financial situation? It all starts with a detailed picture of your credit. Fortunately, you can quickly get your free credit report from all three major credit bureaus: Equifax, Experian, and TransUnion.

- By requesting a free credit report, you can discover any potential errors or unfavorable items that could be lowering your credit score.

- Once you have a solid understanding of your credit report, you can implement strategies to improve your financial well-being.

Consider creating a budget, paying your bills on time, and maintaining your credit card debt. Taking control of your finances is a rewarding endeavor that can lead to enhanced financial stability.

Elevate Your Credit Score: Strategies for Improvement

A robust credit score is essential for achieving financial prosperity. It can unlock favorable interest rates on loans and credit cards, as well as influence your ability to acquire rental properties. Fortunately, there are proven methods to improve your credit score over time. First and foremost, regularly making payments on time is crucial. Aim to clear your obligations in full and reduce late payments whenever possible.

- Analyze your credit report regularly for any discrepancies and challenge them promptly with the relevant credit bureaus.

- Leverage a variety of credit accounts, such as loans, to demonstrate responsible debt handling.

- Preserve your credit utilization ratio low by using a limited percentage of your available credit limit.

- Limit the number of hard inquiries on your credit report by only applying for credit when necessary.

Time is key when it comes to improving your credit score. By consistently implementing these approaches, you can foster a healthy credit profile and unlock a click here world of financial possibilities.

Keep Track of Your Credit

Protecting your financial well-being starts with understanding credit standing. Fortunately, several free credit monitoring services can be found to help you stay informed. These services commonly provide notifications when there are updates to your credit report, such as new accounts. By tracking your credit regularly, you can spot potential errors early on and take steps to address them.

It's essential to review your credit report at least once a year from all three major credit bureaus: Equifax, Experian, and TransUnion. You are allowed to a free credit report from each bureau every 12 months. Utilize these free resources to preserve your financial health and enhance your credit score.

Understanding the Value of a Good Credit Score

A high credit score is more than just a number; it's a key that unlocks financial possibilities. When you have a strong credit history, lenders view you as a reliable borrower, making it easier to get loans for important life events like buying a home or securing a car. Furthermore, a good credit score can help you achieve lower interest rates on your credit cards, ultimately saving you money over time.

Conversely, a low credit score can have detrimental consequences. You may face higher financing charges, limited access to credit, and even obstacles in finding positions. Building and maintaining good credit is a crucial step towards economic well-being.

- Understand with the factors that affect your credit score, such as payment history, credit utilization, and length of credit history.

- Monitor your credit report regularly for errors and dispute any concerns promptly.

- Pay payments on time, every time, to demonstrate your responsibility.

- Keep credit card balances below 30% of their limits.

Understanding Credit Score Basics: A Comprehensive Guide

Your credit score is a vital number that reflects your monetary responsibility. Lenders utilize this rating to determine your worthiness in settling borrowed funds. A higher credit score signals a lower risk, leading to more favorable loan agreements. Building and maintaining a good credit score is essential for achieving monetary success.

- Elements that affect your credit score include payment history, amounts owed, age of credit history, financing mix, and new credit.

- Tracking your credit report regularly allows you to detect any inaccuracies and take steps to resolve them.

- Tactics for enhancing your credit score encompass making timely payments, keeping credit utilization low, and avoiding requests for new credit often.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Christina Ricci Then & Now!

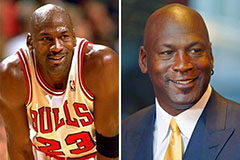

Christina Ricci Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!